A Step-by-Step Guide to Alcohol Production Compliance in South Africa

Navigate the legal landscape of alcohol production in South Africa. Learn the essential steps to ensure compliance with WCLA and SARS, manage bonded vs. unbonded stock, and implement digital tools for streamlined record-keeping and audits.

Understanding Compliance in South African Alcohol Production

Starting an alcohol production business in South Africa is both an exciting and challenging venture. Whether you’re launching a new craft distillery, expanding your brand, or moving from hobbyist to commercial producer, compliance is non-negotiable. Navigating regulatory requirements, managing production documentation, and understanding the difference between bonded and unbonded stock are all key to operating legally and efficiently. Getting this right from the beginning protects your business, builds credibility, and avoids costly penalties.

Licensing and Regulatory Requirements (WCLA & SARS)

Before you can legally distill or sell a single bottle of alcohol, you need to register with two key authorities:

- WCLA (Western Cape Liquor Authority): If you’re located in the Western Cape, any alcohol manufacturing, selling, or distribution activity requires a valid license issued by the WCLA. There are various license types depending on your business model (e.g., micro-manufacturing or distribution). The process includes inspections, proof of safety compliance, and submission of a business plan.

- SARS (South African Revenue Service): All alcohol producers must register with SARS and obtain an excise number. This registration covers tax obligations related to alcohol production and mandates the monthly submission of reports detailing production volumes and sales. Even small-scale or craft producers are legally required to register.

Without proper licensing and registration, your operation is deemed illegal, and the penalties can be severe—including business closure and criminal charges.

Documenting Production: Mash Bills and Distillation Logs

Accurate documentation of each stage in alcohol production is a legal requirement and a best practice for quality control:

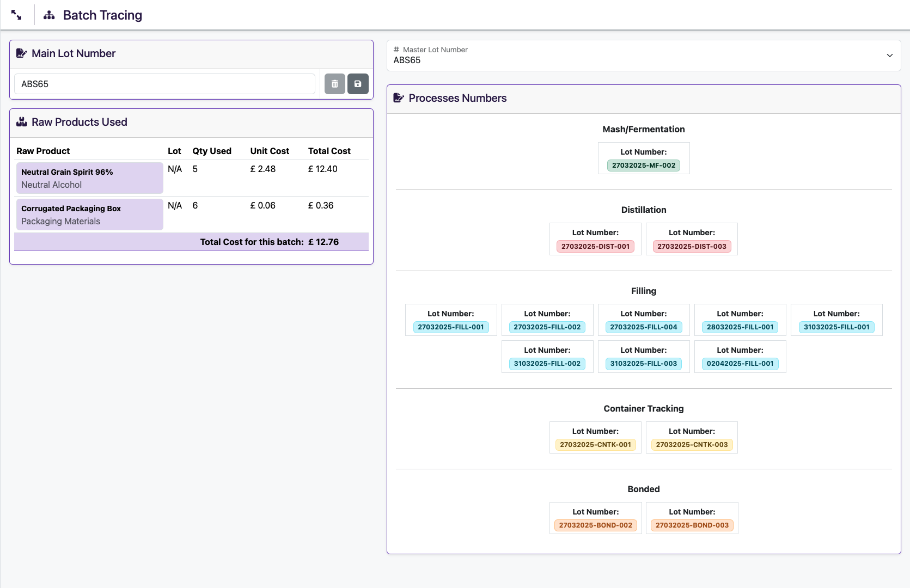

- Mash Bills: These detail the specific recipe or grain composition used in each batch—e.g., 70% maize, 20% rye, 10% barley. Every mash bill must be archived and linked to its corresponding production record.

- Distillation Logs: Each distillation session should be logged with the date, equipment used, type of spirit, batch size, and volume of pure alcohol recovered. These records support SARS compliance and excise calculation.

- Other Records: Fermentation logs, maturation notes, and bottling data are also recommended for full traceability. Keeping detailed records improves transparency, simplifies audits, and builds trust with authorities and partners.

Bonded vs. Unbonded Stock: Know the Difference

One of the most critical aspects of alcohol compliance in South Africa is understanding how to manage bonded and unbonded stock:

- Bonded Stock: Alcohol that has been produced but has not yet had excise duty paid. This stock must be securely stored in a SARS-registered bonded warehouse. It cannot be sold or removed until excise has been paid.

- Unbonded Stock: This is alcohol for which excise duties have already been paid. It can be sold or distributed without restriction.

Compliance Tip: Always keep bonded and unbonded stock clearly labeled and physically separated in your facility. Confusing the two during an audit or inspection can lead to hefty fines or legal repercussions.

Digital Tools That Simplify Compliance

Staying compliant is far easier when your systems are digital. Several software solutions can help manage records, automate reports, and prevent compliance oversights:

Adopting digital tools not only streamlines compliance but also saves time and reduces the risk of human error, letting you focus more on production and growth.

Back