Why Alcohol Producers in 2025 Can't Afford to Operate Without Industry-Specific Software

You're not just making spirits, wine, beer, or cider — you're running a business. And in 2025, spreadsheets and generic ERPs just don’t cut it.

Excise Duty in South Africa: What Alcohol Producers Must Know in 2025

Let’s not sugar-coat it — if you produce alcohol in South Africa, excise duty is part of your daily reality. Whether you're a small craft distillery or a full-scale commercial winery, SARS expects your numbers to be accurate, timely, and backed by clear documentation.

Yet, many producers are still manually calculating excise on spreadsheets or relying on outdated ERP systems not built for the industry. That’s a risky game to play.

Here’s what every alcohol producer in South Africa needs to know in 2025 about excise duty — and how to stay compliant without making it your full-time job.

What is Excise Duty — and How It’s Calculated

Excise duty is a tax charged on certain locally produced goods — alcohol included. It’s not a flat fee or simple sales tax. It’s calculated based on how much pure alcohol your product contains.

The basic formula SARS uses is:

Excise Duty = Volume (in litres) × ABV (%) × Excise Rate per Litre of Absolute Alcohol (LAA)

That "LAA" (litre of absolute alcohol) matters. You're being taxed on the ethanol content — not the product volume. A 750ml bottle of gin at 43% ABV? That’s 0.3225 litres of absolute alcohol. Multiply that by the current rate for spirits, and you’ve got your per-bottle duty.

These rates aren’t fixed either — the National Treasury reviews and adjusts them annually during the Budget Speech. As of 2025, the cost of compliance has only gone up.

SARS Rules: No Room for Error

The South African Revenue Service (SARS) doesn't just want payment — it wants a paper trail. And if you’re operating under a bonded warehouse, the rules tighten further.

Here’s what SARS expects:

- Monthly excise submissions using DA 260 forms

- Real-time, accurate production records — from raw inputs to final dispatch

- Loss declarations — including evaporation, spillage, destruction, and breakages

- Bonded warehouse controls — ensuring goods aren’t removed until excise is paid

- Audit-readiness — your documents, logs, and records must align with physical stock

Failure to comply? You’re looking at penalties, seizure of goods, or worse — operational shutdowns.

Managing Excise Reporting Through Software

Manually keeping up with all this in Excel? That’s a compliance nightmare waiting to happen.

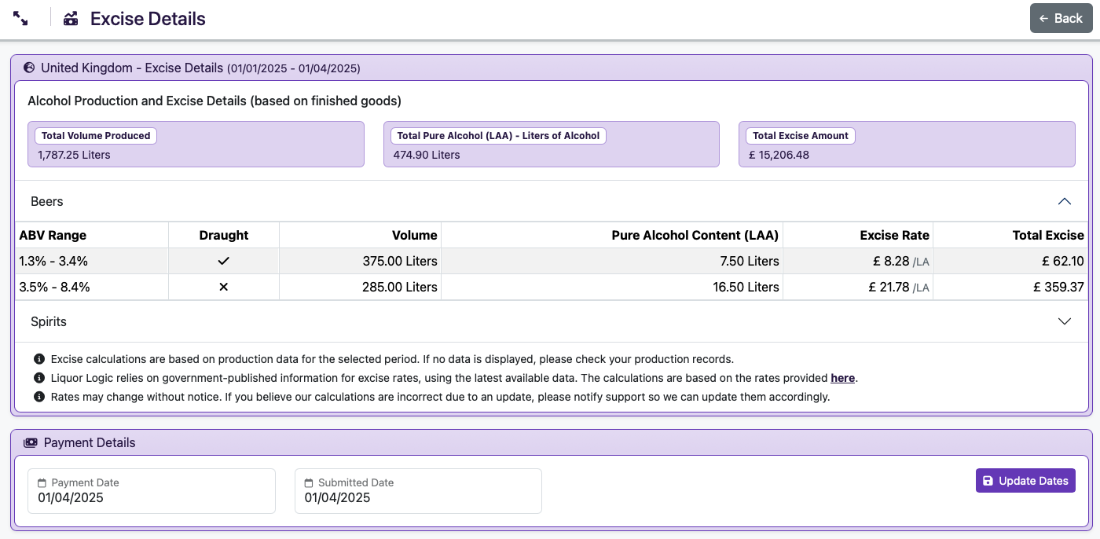

This is where industry-specific software like Liquor Logic comes in.

With a built-in excise management engine, Liquor Logic helps alcohol producers:

- Auto-calculate excise per batch based on volume and ABV

- Generate DA 260 forms aligned with SARS formats

- Track bonded vs duty-paid stock, including barrel ageing losses

- Log all product movements — mashing, fermentation, blending, bottling, etc.

- Maintain audit trails with full traceability from grain to glass

Some producers even integrate barcode scanning for instant linking between stock movements and excise declarations. That means fewer errors, faster audits, and no more scramble at month-end.

The Hidden Risks of Manual Tracking

If you’re still managing excise manually, here’s what you’re up against:

- Incorrect duty calculations due to ABV or volume misentries

- Missed deadlines leading to daily penalties

- Human errors — reversed digits, missing loss declarations, outdated rates

- Audit gaps — inconsistent logs and lack of traceability during SARS inspections

SARS audits have increased in both frequency and severity. If your process can't stand up to scrutiny, you’re exposed — plain and simple.

Take Control with Purpose-Built Software

Excise duty isn’t going away — and neither is SARS.

But managing it doesn’t have to be a burden.

With Liquor Logic, excise is baked into your production flow. You’re not bolting on compliance after the fact — it’s part of how you run your business from day one.

Whether you're tracking evaporation losses in barrels, splitting bonded from duty-paid stock, or producing blended spirits with variable ABV — we’ve built the system to handle it.

No more guesswork. No more fines. Just full compliance, handled.

Back